++++++++++

ATTENTION!!! URGENT!! IMPORTANT!!

++++++++++

FTC Sends Refund Checks to Tech Support Scam Victims

The Federal Trade Commission will begin sending refunds totaling more than $1.7 million to consumers who were victims of a tech support scam. The scam tricked consumers into buying tech support services by claiming their computers were infected with viruses, malware, or other security breaches.

The FTC, along with State of Connecticut and Commonwealth of Pennsylvania, alleged that the perpetrators of the scheme, which operated under Click4Support and other names, used ads on search engines like Google and popups on websites. The ads and popups claimed to be from major tech companies such as Microsoft and Apple and tricked consumers into calling the defendants and buying tech support services that consumers did not need.

The FTC will begin providing 57,960 refunds averaging about $30 each to victims of the scheme. Most recipients will get their refunds via PayPal, but those who receive checks should deposit or cash their checks within 60 days, as indicated on the check. The FTC never requires people to pay money or provide account information to cash a refund check. If recipients have questions about the refunds, they should contact the FTC’s refund administrator, Rust Consulting, Inc., at 1-877-389-4472.

The FTC’s new interactive dashboards for refund data provide a state-by-state breakdown of FTC refunds. In 2019, FTC actions led to more than $232 million in refunds to consumers across the country.

The Federal Trade Commission works to promote competition, and protect and educate consumers. You can learn more about consumer topics and file a consumer complaint online or by calling 1-877-FTC-HELP (382-4357). Like the FTC on Facebook, follow us on Twitter, read our blogs, and subscribe to press releases for the latest FTC news and resources.

Contact Information

CONTACT FOR CONSUMERS:

Refund Administrator

Rust Consulting, Inc.

877-389-4472

–

(Article source: https://www.ftc.gov/news-events/press-releases/2020/02/ftc-sends-refund-checks-tech-support-scam-victims?utm_source=govdelivery/)

++++++++++

Those (not really) IRS calls

by Lisa Weintraub Schifferle

Attorney, FTC, Division of Consumer & Business Education

You’ve probably gotten one of these calls: They say it’s the IRS and they’re filing a lawsuit against you for back taxes. They may threaten to arrest or deport you. What do you do? Watch this video to learn more:

++++++++++

IG Warns Public About Fraudulent Phone Calls Threatening Arrest or Legal Action

The Acting Inspector General of Social Security, Gale Stallworth Stone, is urging citizens to remain vigilant of telephone impersonation schemes that exploit the Social Security Administration’s (SSA) reputation and authority.

The Acting Inspector General of Social Security, Gale Stallworth Stone, is urging citizens to remain vigilant of telephone impersonation schemes that exploit the Social Security Administration’s (SSA) reputation and authority.

The Office of the Inspector General (OIG) continues to receive reports from across the country about fraudulent phone calls from people claiming to be from SSA. Recent reports have indicated that unknown callers are using increasingly threatening language in these calls. The callers state, due to improper or illegal activity with a citizen’s Social Security number (SSN) or account, a citizen will be arrested or face other legal action if they fail to call a provided phone number to address the issue. This is a scam; citizens should not engage with these calls or provide any personal information.

SSA employees do contact citizens, generally those who have ongoing business with SSA, by telephone for customer-service purposes. However, SSA employees will never threaten you for information; they will not state that you face potential arrest or other legal action if you fail to provide information. In those cases, the call is fraudulent, and you should just hang up.

“Unfortunately, scammers will try anything to mislead and harm innocent people, including scaring them into thinking that something is wrong with their Social Security account and they might be arrested,” Stone said. “I encourage everyone to remain watchful of these schemes and to alert family members and friends of their prevalence. We will continue to track these scams and warn citizens, so that they can stay several steps ahead of these thieves.”

The OIG recently warned that some of these impersonation calls have “spoofed” SSA’s national customer service phone number, displaying 1-800-772-1213 as the incoming number on caller ID.

The Acting Inspector General urges citizens to be extremely cautious, and to avoid providing information such as your SSN or bank account numbers to unknown persons over the phone or internet unless you are certain of who is receiving it. If you receive a suspicious call from someone alleging to be from SSA, you should report that information to the OIG at 1-800-269-0271 or online at https://oig.ssa.gov/report.

For more information, please visit https://oig.ssa.gov/newsroom/scam-awareness. For media inquiries, please contact Andrew Cannarsa, OIG’s Communications Director, at (410) 965-2671.

++++++++++

Fake calls about your SSN

December 12, 2018

The FTC is getting reports about people pretending to be from the Social Security Administration (SSA) who are trying to get your Social Security number and even your money. In one version of the scam, the caller says your Social Security number has been linked to a crime (often, he says it happened in Texas) involving drugs or sending money out of the country illegally. He then says your Social is blocked – but he might ask you for a fee to reactivate it, or to get a new number. And he will ask you to confirm your Social Security number.

In other variations, he says that somebody used your Social Security number to apply for credit cards, and you could lose your benefits. Or he might warn you that your bank account is about to be seized, that you need to withdraw your money, and that he’ll tell you how to keep it safe.

But all of these are scams. Here’s what you need to know:

- The SSA will never (ever) call and ask for your Social Security number. It won’t ask you to pay anything. And it won’t call to threaten your benefits.

- Your caller ID might show the SSA’s real phone number (1-800-772-1213), but that’s not the real SSA calling. Computers make it easy to show any number on caller ID. You can’t trust what you see there.

- Never give your Social Security number to anyone who contacts you. Don’t confirm the last 4 digits. And don’t give a bank account or credit card number – ever – to anybody who contacts you asking for it.

- Remember that anyone who tells you to wire money, pay with a gift card, or send cash is a scammer. Always. No matter who they say they are.

If you’re worried about a call from someone who claims to be from the Social Security Administration, get off the phone. Then call the real SSA at 1-800-772-1213 (TTY 1-800-325-0778). If you’ve spotted a scam, then tell the FTC at ftc.gov/complaint.

++++++++++

Consumer Alert: Free trials can cost you

Free trial offers can grab your attention. They’re easy to sign up for. And they’re, well, free – right? Not exactly. Some free trials can be expensive. Scammers often use “free” trial offers, with undisclosed or buried terms, to enroll you – without your knowledge – in costly membership programs.

At the Federal Trade Commission, we’re actively fighting to take down these scammers. Today, we announced a case against a group of them. But the best first line of defense is you. Please watch this video, know the signs of a free trial scam, and share them with your friends and family.

To learn more about free trial offers, visit FTC.gov/freetrials. If you’ve been wrongly charged for a free trial offer, report it to the FTC.

++++++++++

by Karen Dodge

Staff Attorney, Midwest Region, FTC

We’ve all known for a long time that scammers ask people to pay by wiring money. Money wiring companies like MoneyGram and Western Union have also known that scammers have people wire money using their services. In fact, the FTC has sued both companies – which have paid a lot of money to settle those charges – over exactly that issue. When the FTC settled with those companies (MoneyGram in 2009, Western Union in 2017), they also agreed to make changes to protect people from fraud. Except MoneyGram didn’t actually take some of those important steps.

++++++++++

FTC Halts Purveyors of Sham Health Insurance Plans

Florida-based Simple Health Plans LLC has collected more than $100 million with deceptive schemes targeting Americans in need of coverage.

At the request of the Federal Trade Commission, a federal judge temporarily shut down a Florida-based operation that allegedly collected more than $100 million by preying on Americans in search of health insurance, selling these consumers worthless plans that left tens of thousands of people uninsured. Many of these consumers have incurred substantial medical expenses and have been stuck with thousands of dollars in unpaid medical bills.

A federal court temporarily halted the operation pending resolution of the case. The FTC seeks to permanently stop the defendants’ practices and return money to consumers.

In a complaint filed in federal court against Simple Health Plans LLC, the company’s owner, Steven J. Dorfman, and five other entities, the FTC alleged that the defendants misled people to think they were buying comprehensive health insurance that would cover preexisting medical conditions, prescription drugs, primary and specialty care treatment, inpatient and emergency hospital care, surgical procedures, and medical and laboratory testing.

Consumers who enrolled reported paying as much as $500 per month for what was actually a medical discount program or extremely limited benefit program that did not deliver the promised benefits and effectively left consumers uninsured, the FTC alleged.

“Many consumers were misled into thinking they had purchased comprehensive health insurance, but when they needed to rely on that insurance, they learned they had none of the promised benefits,” said Andrew Smith, the Director of the FTC’s Bureau of Consumer Protection. “The plans defendants were selling are not health insurance and they aren’t a substitute for health insurance. Get the details in writing and take your time before signing up for any of these plans.”

According to the FTC’s complaint, the defendants behind Simple Health lured consumers through a network of deceptive lead generation websites that claimed to provide information about comprehensive health insurance. On the sites, the defendants falsely held themselves out as experts on and providers of government-sponsored health insurance policies, such as those offered under Medicare and the Affordable Care Act. In many cases, the sites also misleadingly featured the logos of the AARP or well-known insurance carriers, such as Blue Cross Blue Shield plans, when in fact the defendants were not affiliated with such entities.

For example, one of the websites, www.trumpcarequotes.com, deceptively claimed to offer “Health Insurance for Smart People” from “the Nation’s Leading Carriers” at “Low Affordable Premiums” with “Prescription Drug Coverage.” Another Simple Health website, www.simplemedicareplans.com, promoted “Medicare Health Plans for Your Needs and Budget.”

According to the FTC’s complaint, consumers who submitted their contact information to one of the defendants’ websites or called one of the toll-free phone numbers on the sites ended up on the phone with telemarketers working for the defendants. The telemarketers often falsely identified themselves as insurance agents licensed in the consumer’s state.

The defendants’ telemarketers led consumers to believe that for a one-time enrollment fee, ranging from approximately $60 to $175, and a monthly payment, ranging from approximately $40 to $500, Simple Health could provide them with a “PPO” health insurance plan that was comprehensive and widely accepted by doctors in the consumers’ geographical areas, the FTC alleged. In many cases, they promised that the plans would have no copays or deductibles.

Those who enrolled subsequently learned that the plans they had purchased from Simple Health are not comprehensive health insurance and do not provide the promised coverage and benefits. A typical plan provides no coverage for preexisting medical conditions or prescription medications, pays only $50 toward physician visits—capped at three visits per year—and covers a maximum of $100 per day for hospitalization. The maximum benefit a consumer could realize from the plan is $3200 per person, per year, and only if that person were hospitalized for 30 days.

The FTC alleged that as a result, tens of thousands of consumers who thought they had purchased comprehensive health insurance found themselves uninsured, some saddled with substantial medical expenses that they assumed would be covered by the purported health insurance they had obtained from Simple Health.

On top of that, because the defendants’ limited benefit plans and discount memberships do not qualify as health insurance under the Affordable Care Act, some people who enrolled were subject to a fee imposed on those who can afford health insurance, but choose not to buy it, the FTC alleged.

The defendants are charged with violating the FTC Act and the agency’s Telemarketing Sales Rule. The defendants named in the complaint are Steven J. Dorfman, Simple Health Plans LLC, Health Benefits One LLC, Health Center Management LLC, Innovative Customer Care LLC, Simple Insurance Leads LLC, and Senior Benefits One LLC.

The Commission wishes to thank the Broward County Sheriff’s Office, the Miami-Dade Police Department, The Transportation Security Administration – Miami and Fort Lauderdale Office, the IRS Financial Crimes Task Force – Orlando Division, and the Dallas County Constable Precinct 3 for their support in this matter.

The Commission vote approving the complaint was 5-0. The U.S. District Court for the Southern District of Florida entered a temporary restraining order against the defendants on October 31, 2018, and a preliminary injunction hearing is currently scheduled for November 14, 2018.

The Federal Trade Commission works to promote competition, and protect and educate consumers. You can learn more about consumer topics and file a consumer complaint online or by calling 1-877-FTC-HELP (382-4357). Like the FTC on Facebook, follow us on Twitter, read our blogs, and subscribe to press releases for the latest FTC news and resources.

Contact Information

MEDIA CONTACT:

Peter Kaplan

Office of Public Affairs

202-326-2334

Related Case

For Consumers

++++++++++

Recognize Scammers Who Pretend to Be from the Government

You know those posters businesses must hang up with information about labor laws? You can get them for free from the U.S. Department of Labor. If someone tries to charge you for them, it’s a scam. And this is only one way government imposters try to trick small business owners.

Other ways scammers impersonate the government to con your small business

Scammers contact you and say they’re with a government agency. They threaten to fine you, sue you or suspend your license if you don’t pay them.

Some scammers send letters that look like they’re from the U.S. Patent and Trademark Office. The letters threaten severe consequences: “Pay immediately or lose your trademarks.”

Others lie and say you can pay to get access to government grants for your business.

What to do

No matter the threats, verify the claim before you pay. Contact the government agency directly to find out if the story is true.

This is a free service provided by the Federal Trade Commission (https://www.FTC.gov)

++++++++++

Don’t Pay for Products You Didn’t Order

Like so many entrepreneurs, you’re busy running your business all day long. So when someone calls and says they just want to confirm an order for office supplies, you may oblige without thinking twice about whether that caller is really a scammer.

A few days later, you get a delivery of products you didn’t order — and a big bill. They hope you’ll pay without noticing that you never ordered the merchandise. If you don’t pay, they may make harassing calls demanding payment. The scammers might even lie about your earlier phone conversation, claiming that it’s proof of your order.

How can you avoid falling for a scam like this? Verify your invoices. Don’t pay an invoice unless you’ve confirmed that someone placed the order.

Protect yourself and your business

Learn about common scams that target small businesses, the tactics scammers use, and what steps you can take to protect your business from scams. Click to read Scams and Your Small Business: A Guide for Business.

++++++++++

Protect Your (and Your Children’s) Identity When You Travel!

Experian estimates that approximately 25 percent of children will fall victim to identity theft before adulthood. Unfortunately, children may be unaware that some seemingly harmless activities can further jeopardize their identities while traveling.

We created the new Million Mile Secrets guide, “Protect Your (and Your Children’s) Identity When You Travel!“, in order to discuss:

- How certain social media and internet use can put a child’s identity at risk while traveling

- What precautions should be taken to keep a child’s identity secure

- Which steps to take if your child’s identity is stolen

If parents suspect their child may have become a target of identity theft, our guide includes an updated table of each state’s credit freeze guidelines.

You can view the guide here: https://millionmilesecrets.com/guides/protect-your-and-your-childrens-identity-when-you-travel/

All the best,

Blake Hughes

Million Mile Secrets

1101 Red Ventures Drive

Fort Mill, SC 29707

++++++++++

Don’t get swamped buying a flood-damaged car

by Colleen Tressler

Consumer Education Specialist, FTC

In the wake of the recent hurricanes, used car buyers should use caution: Storm-damaged vehicles are sometimes cleaned up and taken out of state for sale. You might not know a vehicle is damaged until you take a closer look or have a mechanic check it out.

https://www.consumer.ftc.gov/blog/2018/10/dont-get-swamped-buying-flood-damaged-car/

++++++++++

College test prep scams are happening

by Ari Lazarus

Consumer Education Specialist, FTC

Recently, we heard about scams targeting parents of high school students preparing for college. The scammers claim to be from The College Board – the organization responsible for the PSAT and SAT tests. They call or email you, asking for credit card numbers so they can send PSAT prep materials that the student has supposedly requested. Often the scammers have the student’s name, address and phone number – making them seem more believable. Except your student didn’t ask for materials, and it’s not this group calling.

(For more information please visit: https://www.consumer.ftc.gov/blog/2018/10/college-test-prep-scams-are-happening/)

++++++++++

|

++++++++++

Free credit freezes are here

by Andrew Smith, Federal Trade Commission, Director, Bureau of Consumer Protection

Gail Hillebrand, Bureau of Consumer Financial Protection, Associate Director, Division of Consumer Education and Engagement

Free credit freezes and year-long fraud alerts are here, starting September 21st, thanks to a new federal law. Here’s what you should know:

++++++++++

Your Social Security Number isn’t suspended. Ever.

A caller says that he’s from the government and your Social Security Number (SSN) has been suspended. He sounds very professional. So you should do exactly what he says to fix things…right?

Wrong.

The FTC has gotten reports about scammers trying to trick people out of their personal information by telling them that they need to “reactivate” their supposedly “suspended” SSNs. The scammers say the SSN was suspended because of some connection to fraud or other criminal activity. They say to call a number to clear it up – where they’ll ask you for personal information.

Thing is, Social Security Numbers do not get suspended. This is just a variation of a government imposter scam that’s after your SSN, bank account number, or other personal information. In this variation of the scheme, the caller pretends to be protecting you from a scam while he’s trying to lure you into one.

Here are a few tips to protect yourself:

- Never give out or confirm personal information over the phone, via email or on a website until you’ve checked out whoever is asking you for it.

- Do not trust a name, phone number, or email address just because it seems to be connected with the government. Con artists use official-sounding names and may fake caller ID or email address information to make you trust them. Besides, the government normally contacts people by postal mail.

- Contact government agencies directly, using telephone numbers and website addresses you know to be legitimate.

If someone has tried to steal your personal information by pretending to be from the government, report it to the FTC.

++++++++++

Wise giving after a hurricane

September 12, 2018

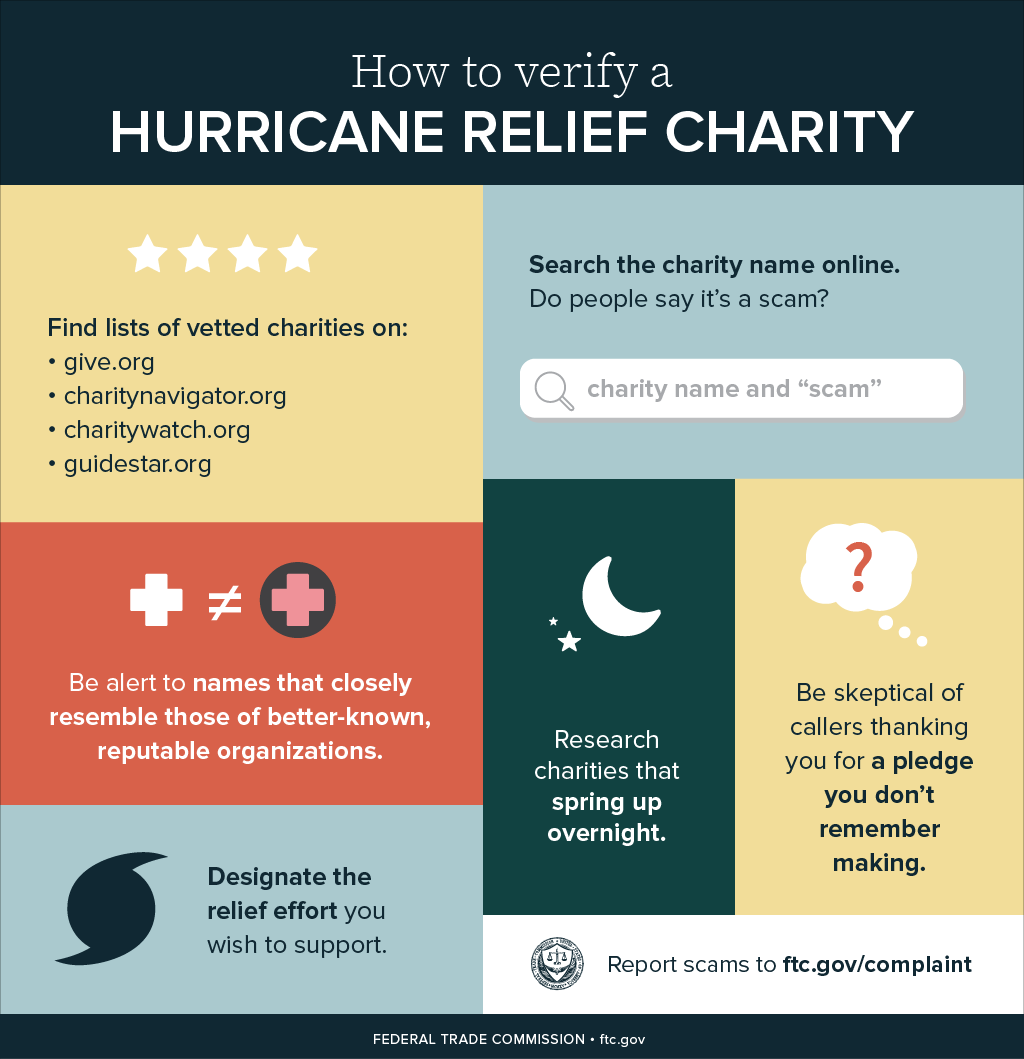

The 2018 hurricane season is upon us. If you haven’t made storm preparations, now is the time. The FTC has information to help you prepare for, deal with, and recover from the long-term impacts of a weather emergency. But how about the rest of us ready to help with donations after a hurricane? You should know about how to avoid hurricane relief charity fraud.

Here’s the rundown. After a hurricane hits, people rush to help those in need. If you are making a donation for hurricane relief, remember to give enough thought to where exactly you are sending your money. Because scammers are hoping that generous people like you, in your eagerness to help, won’t do your homework so they can steal that money. The best way to avoid this and other kinds of charity fraud is to go online and do your research to make sure your money goes to a reputable organization.

You can start at ftc.gov/charity – we have articles and resources, including links to six organizations that can help you check out individual charities.

For more information, check out our charity fraud video and infographic on verifying a hurricane relief charity.

Have a charity fraud complaint? Tell us, at ftc.gov/complaint.

++++++++++

by Alvaro Puig

Consumer Education Specialist, FTC

We recently wrote about steps that the FTC took to stop MOBE, an internet business-coaching scheme that was promoting a bogus online business opportunity to retirees and veterans. We’ve gotten a lot of questions from MOBE customers on our consumer blog and business blog. Here’s what you need to know if you were a MOBE customer.

++++++++++

Watch out for card skimming at the gas pump

by Colleen Tressler

Consumer Education Specialist, FTC –

With the summer travel season in high gear, the FTC is warning drivers about skimming scams at the pump.

(For more information please visit: https://www.FTC.gov)

++++++++++

FTC Action Halts Phony Grants Operation

Defendants allegedly took millions of dollars from consumers seeking help with paying debts and personal expenses

Defendants allegedly took millions of dollars from consumers seeking help with paying debts and personal expenses

At the Federal Trade Commission’s request, a federal court has halted a telemarketing scheme that took at least $3 million from consumers, including elderly and disabled persons, who sought help with paying personal expenses, such as credit card debts, medical bills, and home repairs.

The FTC alleges that the defendants falsely told consumers they could get $10,000 or more in government or private grant money by using the defendants’ service. They charged up-front fees ranging from $295 to $4,995, and routinely told consumers that, for an additional fee, they could either obtain more grant money or receive the money faster.

According to the FTC, most, if not all, consumers received nothing from the defendants and ended up deeper in debt. The defendants operated under many names, often changing names when they received consumer complaints or cease and desist notices from state attorneys general, or when they lost merchant accounts, which are used to process charges to consumers’ credit and debit card accounts.

The defendants are Hite Media Group, LLC, also doing business as Premium Grants and PremiumGrants.com; Premium Business Solutions LLC and Premium Domain Services LLC, both also d/b/a Premium Services, Premium Grants and PremiumGrants.com; 2 Unique LLC, also d/b/a Premium Services, Unique Grants.com, and Grant Support; Amazing App LLC; Michael Ford Hilliard; Michael De Rosa; Shawn Stumbo; Tiffany Hoffman; and Jeremy Silvers. They are charged with violating the FTC Act and the Telemarketing Sales Rule.

The Commission vote authorizing staff to file the complaint was 5-0. The U.S. District Court for the District of Arizona entered a temporary restraining order against the defendants on July 17, 2018, and a preliminary injunction hearing is currently scheduled for July 31, 2018. The Phoenix Police Department provided the FTC with significant assistance.

NOTE: The Commission files a complaint when it has “reason to believe” that the law has been or is being violated and it appears to the Commission that a proceeding is in the public interest. The case will be decided by the court.

The Federal Trade Commission works to promote competition, and protect and educate consumers. You can learn more about consumer topics and file a consumer complaint online or by calling 1-877-FTC-HELP (382-4357). Like the FTC on Facebook, follow us on Twitter, read our blogs, and subscribe to press releases for the latest FTC news and resources.

Contact Information

CONTACT FOR CONSUMERS:

Consumer Response Center

877-382-4357

CONTACT FOR NEWS MEDIA:

Frank Dorman

Office of Public Affairs

STAFF CONTACT:

J. Ronald Brooke, Jr.

Bureau of Consumer Protection

202-326-3484

Russell S. Deitch

Bureau of Consumer Protection

202-326-2585

(For more info on FTC Alerts and warnings about Scams visit: https://www.ftc.gov/)

++++++++++

You’re working on your computer when, suddenly, a message pops up on the screen: “Virus detected! Call now for a free security scan and to repair your device.” That’s a tech support scam. Don’t call, text, or email. Legit tech support companies don’t operate that way.

Scammers pose as big-name companies and use pop-up messages, fake websites, and phone calls to trick you into thinking your computer has an urgent problem. Their plan is to get your money by selling you worthless software, enrolling you in fake programs, or getting you to pay for useless tech support. The scammers urge you to call a toll-free number immediately, threatening that you may lose personal data if you don’t.

When you call, the scammer might ask you to give them remote access, pretend to run a diagnostic test, or tell you they’ve found a virus or other security issue. They try to sell you a security subscription or other “services” that range from worthless (for instance, they’re available for free elsewhere) to malicious (they install dangerous software that can help them steal your personal information.)

What should you do? If you get a pop-up to call a number to fix a virus on your computer, ignore it. Your computer is almost certainly fine. But if you’re concerned about your computer, call your security software company directly — and don’t use the phone number in the pop-up or on caller ID. Use a number you know is real, like the one on a software package or your receipt. Tech support scammers like to place online ads pretending to be legitimate companies, so be sure you have the correct telephone number for the real tech company before calling.

And if someone asks you to pay for anything — including tech support services — with a gift card, cash reload card, or a wire transfer, that’s a scam. No legitimate company will tell you to pay that way. If you see that, report it at FTC.gov/complaint.

(Source: https://www.consumer.ftc.gov/blog/2018/07/avoiding-tech-support-scams)

++++++++++

State Auditor Wayne Johnson warns government entities about costly invoicing scam

City of Alamogordo lost $250,000 to fake vendor

Santa Fe, NM – The City of Alamogordo last week paid more than $250,000 to an unknown scam artist, and recovery of that public money is likely to be difficult if not impossible. In light of that scam, State Auditor Wayne Johnson is reminding all of the state’s government entities to be extremely cautious and aware when it comes to e-mail communication from any vendors.

A staff member with the City of Alamogordo received an email request to change banking information from someone who appeared to be a representative of Cooperative Education Services, (CES) a New Mexico purchasing cooperative. The email appeared to come from a person known to work for CES, and contained an outdated version of the CES logo. The City accepted the change in banking information and paid all invoices, only to discover that the email was fraudulent. CES is a commonly used purchasing cooperative for New Mexico schools, and other government entities. City leaders immediately notified law enforcement, including the FBI.

“In this Snapchat and Instant Message world, it’s critical to verify information with a real person, either in person or by phone,” said Johnson. “An email seeking to alter banking information should always be a red flag. Talk to your vendors, especially when they do something out of the ordinary, like send a change in banking information. It’s important to establish personal relationships so that finance staff can talk to people already known to them. There’s no excuse for not taking that extra step to make sure to prevent the theft of a quarter of a million dollars in public money.”

Alamogordo officials have acknowledged that the amount owed to the company was correct, so the request for payment was not unusual. The e-mail appeared to come from an agent the procurement officer knew and had worked with in the past. It bore an official looking logo from CES. The procurement officer didn’t question or confirm the e-mail and the information contained within it. She forwarded it to the finance department which changed the payee information as requested. Payment for outstanding invoices was made for more than $250,000 and went to the fraudulent bank account instead of to the actual vendor.

Later, representatives from CES called requesting payment on the still outstanding invoices. Managers believed payment had already been made, and only then realized they had transferred money to a fraudulent entity.

Today CES is notifying all customers of the potential for fraud. CES has advised the OSA that it has not changed their banking information, nor do they plan to do so.

“Our office has warned local governments before about e-mail scams,” said Johnson. “Those who handle public dollars need to pay attention and realize these scams can happen at any time and they are constantly evolving. These thieves are creative and effective. Public entities have to make sure they have strong anti-fraud procedures and that they are following them in every instance in order to safeguard public money.”

Johnson’s office warned government entities late Friday via the following risk advisory: https://www.saonm.org/media/uploads/GAO-Risk_Advisory-250Kscam2018-07-13.pdf

1-866-OSA-FRAUD www.saonm.org

+++++++++++

Scammers create fake emergencies to get your money

by Carol Kando-Pineda

Attorney, Division of Consumer and Business Education

Scammers try to trick you into thinking a loved one is in trouble. They call, text, email, or send messages on social media about a supposed emergency with a family member or friend. They ask you to send money immediately. To make their story seem real, they may claim to be an authority figure, like a lawyer or police officer; they may have or guess at facts about your loved one. These imposters may insist that you keep quiet about their demand for money to keep you from checking out their story and identifying them as imposters. But no matter how real or urgent this seems — it’s a scam.

(For more on this and other scams visit: https://www.ftc.gov/)

++++++++++

FTC Warns Consumers about Vacation Rental Scams

The FTC is warning consumers to watch out for vacation rental scams. The agency has published a blog post, Getting a vacation rental? Watch out for scams, with a message for consumers who are looking to book a summer rental: Scammers are ready with fake vacation rental ads, and their plan is to take your money and leave you with no place to stay.

The blog post explains how vacation rental scams operate and includes a list of tips on how to avoid them. The blog also encourages consumers who come across any scam rental ads to report them to the FTC.

The Federal Trade Commission works to promote competition, and protect and educate consumers. You can learn more about consumer topics and file a consumer complaint online or by calling 1-877-FTC-HELP (382-4357). Like the FTC on Facebook, follow us on Twitter, read our blogs, and subscribe to press releases for the latest FTC news and resources.

FTC Action Halts MOBE, a Massive Internet Business Coaching Scheme

The Federal Trade Commission has charged three individuals and nine businesses with bilking more than $125 million from thousands of consumers with a fraudulent business education program called MOBE (“My Online Business Education”). A federal court halted the scheme and froze the defendants’ assets at the FTC’s request.

According to the FTC, the defendants behind this international operation target U.S. consumers—including service members, veterans, and older adults—through online ads, social media, direct mailers, and live events held throughout the country. This action follows the agency’s recent action against Digital Altitude, LLC, a competing business opportunity scheme that was also halted by court order.

The FTC alleges that the defendants falsely claim that their business education program will enable people to start their own online businesses and earn substantial income. They claim to have a “proven” 21-step system for making substantial sums of money quickly and easily from internet marketing, which they promise to provide to those who join their program.

According to the complaint, consumers who pay the initial $49 entry fee for the 21-step program are bombarded with sales pitches for membership packages that cost thousands of dollars, which the defendants pressure them to buy in order to continue through the 21 steps. The defendants eventually reveal that their “proven system” for making money is for consumers to sell the same memberships to others in the hopes of earning commissions on those sales.

Most people who buy into the program and pay for the expensive memberships are unable to recoup their costs, and many experience crippling losses or mounting debts, including some who have lost more than $20,000, the FTC alleges.

The FTC also alleges that the defendants offer refund and money-back guarantees to further mislead people to believe the program is risk-free, but they often refuse to honor refund request, or they provide refunds only after buyers make persistent demands or threaten to complain to the Better Business Bureau or law enforcement agencies.

The defendants are Matthew Lloyd McPhee, also known as Matt Lloyd, an Australian living in Kuala Lumpur, Malaysia; Russell W. Whitney, Jr.; Susan Zanghi; MOBE Ltd., also doing business as MOBE, My Online Business Education, and My Own Business Empire; MOBEProcessing.com Inc.; Transaction Management USA Inc.; MOBETraining.com Inc.; 9336-0311 Quebec Inc., also d/b/a Business Education Training; MOBE Pro Limited; MOBE Inc.; MOBE Online Ltd.; and Matt Lloyd Publishing.com Pty Ltd., also d/b/a Matt Lloyd Publishing and Home Business Builders.

The Commission vote approving the complaint was 5-0. The U.S. District Court for the Middle District of Florida, Orlando Division, entered a temporary restraining order against the defendants on June 5, 2018.

NOTE: The Commission files a complaint when it has “reason to believe” that the law has been or is being violated and it appears to the Commission that a proceeding is in the public interest. The case will be decided by the court.

The Federal Trade Commission works to promote competition, and protect and educate consumers. You can learn more about consumer topics and file a consumer complaint online or by calling 1-877-FTC-HELP (382-4357). Like the FTC on Facebook, follow us on Twitter, read our blogs and subscribe to press releases for the latest FTC news and resources.

Contact Information

CONTACT FOR CONSUMERS:

Consumer Response Center

877-382-4357

The Federal Trade Commission is mailing 3,633 checks totaling more than $969,000 to people who lost money to a deceptive telemarketing scheme that promoted business coaching services to people who wanted to start internet businesses.

In January 2018, the Internet Teaching and Training Specialists, LLC (ITT) defendants were banned from selling business coaching services and business opportunities under a settlement with the FTC. ITT sold a business coaching program provided by Guidance Interactive, a company that also settled with the FTC. According to the FTC’s complaint, despite these defendants’ promises, most of their customers did not develop a successful online business, and instead ended up in debt.

Each check is worth $266.78. Recipients should deposit or cash checks within 60 days. The FTC never requires people to pay money or provide account information to cash a refund check. If recipients have questions about the case, they should contact the FTC’s refund administrator, Rust Consulting Inc., at 1-888-812-1569.

To learn more about the FTC’s refund program, visit www.ftc.gov/refunds.

The Federal Trade Commission works to promote competition, and protect and educate consumers. You can learn more about consumer topics and file a consumer complaint online or by calling 1-877-FTC-HELP (382-4357). Like the FTC on Facebook, follow us on Twitter, read our blogs and subscribe to press releases for the latest FTC news and resources.

Contact Information

CONTACT FOR CONSUMERS:

Consumer Response Center

877-382-4357

By Jason Adler – Assistant Director, Midwest Region .

Instead of min(d)ing their own business, are scammers using your computer as their virtual ATM? Three years ago, the FTC warned the public and took action against cryptojacking. That’s where scammers use your device’s processing power to “mine” cryptocurrency, which they can then convert into cold, hard cash.

Cryptojacking scams have continued to evolve, and they don’t even need you to install anything. Scammers can use malicious code embedded in a website or an ad to infect your device. Then they can help themselves to your device’s processor without you even knowing. You might make an unlucky visit to a website that uses cryptojacking code, click a link in a phishing email, or mistype a web address. Any of those could lead to cryptojacking. While the scammer cashes out, your device may slow down, burn through battery power, or crash.

The settlements stem from an FTC-led enforcement sweep announced last year

The defendants in two student loan debt relief cases have agreed to settle Federal Trade Commission claims that they charged consumers illegal upfront fees and falsely promised to help reduce or forgive student loan debt burdens.

The settlements with Strategic Student Solutions and Bloom Law Group are part of a coordinated federal-state law enforcement initiative targeting deceptive student loan debt relief scam announced by the FTC in October 2017, called Operation Game of Loans.

(For more information visit: https://www.ftc.gov/news-events/press-releases/2018/05/operators-student-loan-debt-relief-schemes-settle-ftc-charges?utm_source=govdelivery)

State Auditor Wayne Johnson warns government

agencies about invoicing scam targeting public money

Santa Fe, NM – State Auditor Wayne Johnson is warning state and local agencies today that a scam artist could target their finance employees with fraudulent invoices for significant amounts of money. In the past, some New Mexico entities have fallen victim to such fraud, costing taxpayers thousands.

“These criminals are very savvy and convincing,” said Johnson. “They do their research and often know how specific agencies work, and who works there. We have to be careful and rely on internal control methods to safeguard public money. Unfortunately, over the years we’ve seen schools, cities, and counties fall prey to these scams, costing us more than half a million of valuable tax dollars that could be used for actual services.”

Some government entities have paid invoices before realizing it was fraudulent. In 2017 the City of Albuquerque paid $400,000 and the Silver City School District paid $200,000 to scammers. In 2016, San Miguel County lost $38,000 to a similar scheme.

In the latest case, perpetrators “spoofed” the e-mail of a senior level official in a local school district and created a sense of urgency, demanding that an invoice be paid that day.

On April 18, 2018, the school district’s accounts payable manager received an e-mail that appeared to come from the district’s chief financial officer (CFO). The CFO asked the manager to pay a $26,280.50 invoice immediately. When the accounts manager asked for further information and documentation, the fake CFO replied that it was okay to pay the invoice outside of the normal process and that it was critical to pay immediately.

The employee wasn’t fooled, and reported the scam to her superiors.

The Risk Advisory report can be read here: https://www.saonm.org/media/uploads/GAO_RA_Vendor_Invoicing_Scam.pdf

Government employees and leaders who received e-mails suspected of being fraudulent can e-mail the OSA at reports@osa.state.nm.us or call 505-476-3800.

Scammers target Sept. 11th Victim Compensation Fund

Scammers target Sept. 11th Victim Compensation Fund

2018 Apr 20 by Drew Johnson, Consumer Education Specialist, FTCConsumers are reporting a new imposter scam — this time the callers are pretending to be with the September 11th Victim Compensation Fund (VCF). According to reports, the callers are telling people they may be entitled to money, and they are asking people for their personal information to determine if they are eligible. It’s a scam.Read more >

(For more information see: https://www.consumer.ftc.gov/blog/2018/04/scammers-target-sept-11th-victim-compensation-fund?utm_source=govdelivery)

(Sent using GovDelivery Communications Cloud on behalf of: Federal Trade Commission · 600 Pennsylvania Ave., NW · Washington, DC 20580 · 1-877-382-4357)

FTC Obtains Court Orders Banning Marketer from Negative-Option Sales

The ringleader of an operation that lured people into an expensive negative-option scam using a low-cost “trial” offer for tooth whiteners and other products is banned from negative-option sales under a settlement with the Federal Trade Commission.

The settlement order is one of three orders resolving FTC charges against Blair McNea, Jennifer Johnson, Danielle Foss and 59 corporate defendants. The defendants’ deceptive claims, hidden disclosures and confusing terms tricked people into providing their billing information, supposedly to pay shipping and a nominal cost for a trial product. They charged consumers for two ongoing subscriptions to nearly identical products until the consumers canceled. As a result, consumers who believed they had agreed to buy a single trial product for about $5 were charged about $200 a month until they canceled both unauthorized subscriptions.

Debt Relief Scammers Settle with FTC and Florida; Will Submit $35 Million in Assets for Consumer Redress

Three marketers who allegedly sold phony debt relief services, including fake loans, have agreed to be banned from selling debt relief, credit repair and financial products and services, to be banned from telemarketing, and to turn over assets worth approximately $35 million dollars, under settlements with the Federal Trade Commission and the State of Florida.

For complete article see: https://www.ftc.gov/news-events/press-releases/2018/04/debt-relief-scammers-settle-ftc-florida-will-submit-35-million?utm_source=govdelivery

A New Way to Report Tax Identity Theft

by Seena Gressin

Attorney, Division of Consumer & Business Education, FTC

Identity theft is hard enough. That’s why we keep working to make recovering from it easier. It’s also why we’re happy to let you know about an innovative project by the FTC and IRS that lets people report tax-related identity theft to the IRS online, using the FTC’s IdentityTheft.gov website to file IRS Form 14039.

IdentityTheft.gov website on a laptop, tablet, and smartphone.

FTC Shuts Down Promoters of Deceptive Cryptocurrency Schemes

At the request of the Federal Trade Commission, a federal court has halted the activities of four individuals who allegedly promoted deceptive money-making schemes involving cryptocurrencies. These schemes falsely promised that participants could earn large returns by paying cryptocurrency such as bitcoin or Litecoin to enroll in the schemes.

In a complaint, the FTC alleges that three defendants – Thomas Dluca, Louis Gatto, and Eric Pinkston – promoted chain referral schemes known as Bitcoin Funding Team and My7Network. Using websites, YouTube videos, social media and conference calls, the defendants promised big rewards for a small payment of bitcoin or Litecoin.

The defendants claimed that Bitcoin Funding Team could turn a payment of the equivalent of just over $100 into $80,000 in monthly income. The FTC alleges, however, that the structure of the schemes ensured that few would benefit. In fact, the majority of participants would fail to recoup their initial investments.

(See the full story at: https://www.ftc.gov/news-events/press-releases/2018/03/ftc-shuts-down-promoters-deceptive-cryptocurrency-schemes?utm_source=govdelivery)

++++++++++

FTC Sending Refund Checks Totaling More Than $7.2 Million to Consumers Who Bought Deceptively Marketed “Buy-One-Get-One-Free” Products

Company often billed consumers without their consent

The Federal Trade Commission is mailing 218,254 refund checks totaling more than $7.2 million to people who bought products deceptively marketed as “buy-one-get-one-free,” including Snuggies, the Magic Mesh Door, and other “as-seen-on-TV” type products. Consumers who bought products marketed by Allstar Marketing Group, LLC will receive checks averaging $33.14.

In March 2015, the FTC alleged that since at least 1999, Allstar used direct marketing TV commercials to sell its products, many of which are familiar to consumers. While the products varied, Allstar’s pitch often was the same—a “buy-one-get-one-free” offer that did not disclose all the costs. Because the ordering process was confusing, some customers also were charged for more products than they wanted.

The court order settling the FTC’s charges barred Allstar from engaging in the allegedly illegal conduct and imposed a monetary judgment of $7.5 million to provide refunds to injured consumers. The New York Office of Attorney General, which filed a parallel action against Allstar, has assisted with the refund planning process.

Analytics, the refund administrator for this matter, will begin mailing refund checks today. Consumers should receive their refund checks this month, and they must be cashed within 60 days or they will become void. The FTC never requires consumers to pay money or provide information to cash refund checks. Consumers who have questions should call 1-877-982-1294.

FTC law enforcement actions led to more than $6.4 billion in refunds for consumers in a one-year period between July 2016 and June 2017. To learn more about the FTC’s refund program, including its Annual Report, visit www.ftc.gov/refunds.

The Federal Trade Commission works to promote competition, and protect and educate consumers. You can learn more about consumer topics and file a consumer complaint online or by calling 1-877-FTC-HELP (382-4357). Like the FTC on Facebook, follow us on Twitter, read our blogs and subscribe to press releases for the latest FTC news and resources.

Contact Information

MEDIA CONTACT:

Mitchell J. Katz

Office of Public Affairs

202-326-2161

CONSUMER REDRESS HOTLINE: 1-877-982-1294

++++++++++

The Top Frauds of This Past Year….!

The top frauds of 2017 [As reported by FTC.gov] —

Share This Page

Facebook

Twitter

Linked-In —

March 1, 2018 by Monica Vaca, Associate Director, Division of Consumer Response and Operations

The numbers are in, the counts have been made, and today the FTC announced what we heard from you during 2017. Here are some highlights:

This year’s top fraud is again Imposter Scams, with nearly 350,000 reports. Nearly 1 in 5 people who reported an imposter scam lost money – a whopping $328 million lost to someone pretending to be a loved one in trouble, a government official, tech support, or someone else who’s not who they say they are, but who wants your money.

We heard from nearly 2.7 million people last year. There were fewer debt collection reports in 2017 (23% of all reports), but it’s still the top category by a wide margin, followed by identity theft (14%), which overtook imposter scams (13%) for the number two slot in 2017.

For everyone who reported identity theft, credit card fraud tops the list, and continues to grow. Reports of tax fraud are down 46%, but it was still reported by nearly 63,000 people.

Of the more than 1.1 million people who reported fraud, 21% told us they lost a total of more than $905 million. That’s an increase of $63 million from 2016.

People reported that scammers mostly contacted them by phone, and they mostly paid for frauds – once again – by wire transfer. But check out the $74 million in losses on credit cards, which are charges that could potentially be disputed and recovered, if done in time.

Median losses tell an interesting story: for all fraud reports in 2017, the median loss was $429. Compare that to a $500 median loss to imposters, a $720 median fraud loss to scams that come in by phone, a $1,710 median loss related to travel, vacations and timeshares. Among military consumers, median losses were higher than the general population — $619.

More younger people reported losing money to fraud than older people – but when people aged 70 and older had a loss, it was a much higher median loss than other groups.

And, based on reports per 100,000 population, the top states for fraud reports were Florida, Georgia and Nevada. For identity theft, it’s Michigan, Florida and California.

Have you spotted any scams? If so, tell the FTC – and then come back this time next year to hear what happened during 2018.

Tagged with: credit card, identity theft, imposter, military

Blog Topics:

Money & Credit

++++++++++

Scam Alerts…!

|

|

|

++++++++++

Know the risks before you invest in Cryptocurrencies…!

February 16, 2018

by Elizabeth Kwok

Division of Financial Practices, FTC

It’s not just bitcoin. There are now hundreds of cryptocurrencies, which are a type of digital currency, on the market. They’ve been publicized as a fast and inexpensive way to pay online, but many are now also being marketed as investment opportunities. But before you decide to purchase cryptocurrency as an investment, here are a few things to know:

++++++++++

|

|